Cline Group Takes a Deep Dive Into The Size & Vital Role of U.S. Dive Retailers

Completed October 15 to November 8, 2023

Dive retailers are pivotal in maintaining diver engagement, providing personalized experiences, and fostering a community that is crucial for the industry’s continued vitality. In this article, I take a deep dive into some Cline Group research, as well as DEMA’s research as it relates to dive retailers in the USA.

During the pandemic, our team conducted several global surveys and one, in particular, looked at what should be done to promote diving industry growth. Our “State of the Industry Survey” indicated that resorts, instructors, and dive shops in 47 countries advocated for more local diving and robust support for local dive shops. This sentiment was recorded 91 times in the results [https://www.williamcline.com/wp-content/uploads/Clines_2020_Dive_Industry_Sentiment_Study.pdf]. Conclusion, it’s a universally acknowledged truth: retailers are the backbone of the diving community, not only creating divers but also providing them with local opportunities to dive and thereby keeping the spirit of the industry alive.

Referencing my recent article “10 Reasons Why Print Advertising is not Dead” [https://www.divenewswire.com/10-reasons-why-print-advertising-is-not-dead], I delved into DEMA’s 2023 USA Behavioral Consumer Research Report. With responses from 6,720 divers, this survey is one of the most accurate barometers for current consumer behaviors. Among other fascinating results, we can analyze the purchasing behaviors of divers and it shows a direct correlation of expenditures and local shop interactivity with how they became certified. Data shows divers who begin or complete certification through local dive shops are significantly more engaged—800% more likely to frequent these retailers within the last 30 days and 825% more likely make a hard goods purchase during that visit (i.e., regulators, BCDs, etc.). Additionally, divers who begin or complete certification through local dive shops are more socially connected within the diving community, with 25% more diving acquaintances than those certified on vacation, which in turn, keeps them more active in the sport.

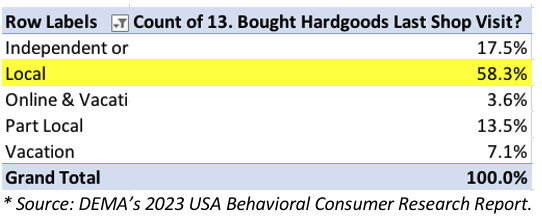

Below is a table from this same consumer survey showing purchasing habits with local dive shops:

Retailers contribute significantly to our industry through the sale of equipment, the facilitation of travel and continued diver engagement. However, it remains to be seen exactly how many dive retailers are operating in the USA in the aftermath of COVID and subsequent economic declines. To answer this question, I led a project that concluded recently, spanning over five weeks where we diligently inventoried every business listed by Google as a dive shop, methodically progressing through each state. The initial tally reached 1,677, but this figure was inflated with defunct businesses and independent instructors mistakenly classified as retail outlets. To ensure accuracy, we embarked on a rigorous verification process. Every Google-listed entity was scrutinized through a combination of Google Street View, social media platforms like Facebook, customer reviews, direct website analysis, and in some cases, confirmation calls to the businesses themselves. We applied stringent criteria for a retailer to be included:

1. Concrete evidence of a brick-and-mortar location accessible to customers.

2. A full range of services had to be available, including diving instruction and equipment sales, complemented ideally by air fill and gear servicing facilities — merely operating a boat charter service did not suffice.

This detailed review culminated in identifying 851 genuine dive retailers in the U.S., including Hawaii. While there’s a slim possibility a few low-profile shops eluded our search, the comprehensive nature of our methodology makes this highly improbable in the digital age.

The 851 dive shops breakdown as follows by state and region (% of whole indicated):

| State / Region | Cline 2023 Retailer Search |

| CALIFORNIA | 8.8% |

| WASHINGTON | 2.8% |

| OREGON | 1.6% |

| HAWAII | 4.8% |

| ALASKA | 0.5% |

| NET PACIFIC | 18.6% |

| COLORADO | 2.0% |

| ARIZONA | 2.6% |

| UTAH | 2.1% |

| NEVADA | 1.2% |

| IDAHO | 0.7% |

| NEW MEXICO | 0.7% |

| MONTANA | 0.8% |

| WYOMING | 0.2% |

| NET MOUNTAIN | 10.3% |

| VIRGINIA/MARYLAND/D.C | 5.3% |

| GEORGIA | 2.9% |

| NORTH CAROLINA | 2.9% |

| SOUTH CAROLINA | 1.6% |

| WEST VIRGINIA | 0.6% |

| DELAWARE | 0.4% |

| FLORIDA | 11.2% |

| NET SOUTH ATLANTIC | 24.9% |

| ILLINOIS | 2.9% |

| MICHIGAN | 2.8% |

| OHIO | 2.7% |

| WISCONSIN | 2.4% |

| INDIANA | 1.6% |

| NET EAST NORTH CENTRAL | 12.5% |

| TEXAS | 6.9% |

| OKLAHOMA | 1.1% |

| ARKANSAS | 1.1% |

| LOUISIANA | 1.2% |

| NET WEST SOUTH CENTRAL | 10.2% |

| NEW YORK | 2.8% |

| PENNSYLVANIA | 3.2% |

| NEW JERSEY | 1.5% |

| NET MIDDLE ATLANTIC | 7.5% |

| MISSOURI | 2.4% |

| MINNESOTA | 1.6% |

| KANSAS | 0.8% |

| IOWA | 0.7% |

| NEBRASKA | 0.6% |

| SOUTH DAKOTA | 0.4% |

| NORTH DAKOTA | 0.1% |

| NET WEST NORTH CENTRAL | 6.6% |

| MASSACHUSETTS | 1.6% |

| CONNECTICUT | 1.2% |

| NEW HAMPSHIRE | 0.9% |

| MAINE | 0.5% |

| RHODE ISLAND | 0.4% |

| VERMONT | 0.1% |

| NET NEW ENGLAND | 4.7% |

| TENNESSEE | 2.1% |

| ALABAMA | 1.9% |

| KENTUCKY | 0.6% |

| MISSISSIPPI | 0.4% |

| NET EAST SOUTH CENTRAL | 4.9% |

Not only did my team review each shop in every state, but we also cataloged the following for every one of the 851 retailers:

• Full mailing addresses

• Websites

• Email addresses

• Training agency affiliation

Determining a precise number of dive shops in the USA is significant; as the number allows for extrapolations of market size for retailers, and possibly even the entire dive industry in the USA. This accurate count is more than a statistic; it’s a benchmark for annual evaluations. Although we currently face limitations in expanding this research globally due to Google’s varying international presence, the goal is to eventually extend this level of detailed analysis to other countries.

Retailers are undeniably the linchpin of the diving industry in the U.S., and the data underscores their importance to our collective success. Participation in the DEMA show is instrumental for retailers to broaden their knowledge in travel, equipment, and to receive training through a host of seminars. These sessions, often curated by a committee of dive shop owners with rich experience, are a treasure trove of industry-specific wisdom. Dan Orr wrote an excellent article specifically about the learning opportunities at the upcoming DEMA Show: (https://www.divenewswire.com/the-dema-show-an-unparalleled-learning-opportunity).

I look forward to the opportunity to meet many of you next week at the DEMA show. If you have time, stop by the Dive Newswire Booth (#2036) and say ‘hi.’ Don’t miss the opportunity to acquire the latest industry insights by downloading the 2023 Blueprint for Growth Dive Retailer Survey and DEMA’s 2023 USA Behavioral Consumer Research Report from dema.org, available at no cost to members. See you at the show!